Times are tough, and economic security may be weighing heavy on your mind.

After all, many people struggle to maintain any savings, much less keep something on hand that can be used when banks aren’t an option.

Stocking up on food, water, ammunition, and medical supplies is important, but if you’re stuck in a situation somewhere between “full societal collapse” and “normal,” chances are–you’ll also need some buying power.

Be it gold, silver, or cold, hard cash, we’re going to talk about investing for all your just-in-case needs.

Disclaimer: Not meant as investment advice.

Table of Contents

Loading…

What’s Wrong with a Savings Account?

If you’ve had any level of financial literacy education, you’ve probably heard that you need to set aside at least 10% of your income in a savings account. Obviously, we’re not about to argue with that logic, but…

Ever needed something really badly, and not been able to reach it?

Yeah, it’s frustrating, right?

Now, imagine that it was a life or death situation. You need to be able to access whatever that thing is, and if you can’t, your family will starve, or die from medical complications, or be unable to escape from danger.

I’m sure you see where I’m coming from–if you don’t have cash, or other valuables, in hand, you don’t have them in an emergency.

When things are functioning like normal, or close to normal, you’ll still have credit cards and debit cards and online payments. You’ll still have a paycheck getting deposited in your account regularly. You might become a bit of a Lysol addict, but ultimately, things will keep ticking on.

But what happens when the banks close, or when the power is out and card terminals go down? Or if you are unable to work from home, are laid off, or are otherwise unable to get a paycheck?

How will you and your loved ones get through?

The answer is–prepping! Prepping should always include a financial component, especially since it’s more realistic that you’ll face the loss of a paycheck than you will the end of the world.

And well… if I’m wrong, at least paper money can be used when all that TP runs out.

Keep Cash on Hand

First step–have dolla dolla bills, y’all!

Cash-in-hand is a great security against most situations you’ll probably face. Honestly, all joking aside, we foresee the US Dollar continuing to be the currency of the realm for the time being, so it doesn’t hurt to keep a stash at home where you can reach it in an emergency.

Ideally, you’ll have a couple hundred bucks on hand, in a variety of denominations–not just twenties. And, if you need it, only carry what you’ll use for what you need.

That means no lugging around a wad of bills, then peeling off a few bucks in plain sight of everyone in the local Circle K, okay? Play it cool.

Gold and Silver: Timeless Investments or Old-Fashioned?

Looking for a way to invest, but want something that’s going to retain its value well? Then it’s time to take a closer look at precious metals.

One benefit to precious metals, like gold, silver, and platinum, is that they hang onto their value pretty dang well. And unlike paper money, you can’t just print more gold.

If you like smaller units of gold…we really like gold “rooster” 20 Franc coins.

-

25% off all OAKLEY products - OAKLEY25

Copied! Visit Merchant

Sure, they have their ups and downs, but unlike the stock market, you actually have a chunk of metal to show for your investment, and precious metals are considered pretty safe investments since they don’t fluctuate too wildly. In fact, gold prices tend to rise as the economy and stock market fall, making it a pretty sweet apocalypse investment.

Besides, precious metals have been valued for pretty much all of human history, so we don’t anticipate that changing soon.

Or for our go-to…1 oz Silver American Eagle coins.

-

25% off all OAKLEY products - OAKLEY25

Copied! Visit Merchant

There’s plenty of late-night infomercials offering you ways to invest in gold without actually buying it but, if you’ve been paying attention, you probably know–if it’s not in your hand, it’s not yours in an emergency.

So Gold ETFs? Not for you, my friend.

It really is as simple as buying a dang ol’ chunk of gold (though, do a little research first so you don’t get ripped off).

Storing Your Investment

Look, you’re not going to leave your brand new golden nest egg sitting in your kitchen junk drawer. Like anything important, it needs to be kept somewhere safe, somewhere subtle, somewhere that you’ll have access but others won’t…

Are you thinking what I’m thinking?

That’s right–a safe.

You can plonk your investments in the back of your gun safe if you have space or you can stash them in their very own safe, what matters is that you can access them on your terms.

Prices accurate at time of writing

Prices accurate at time of writing

-

25% off all OAKLEY products - OAKLEY25

Copied! Visit Merchant

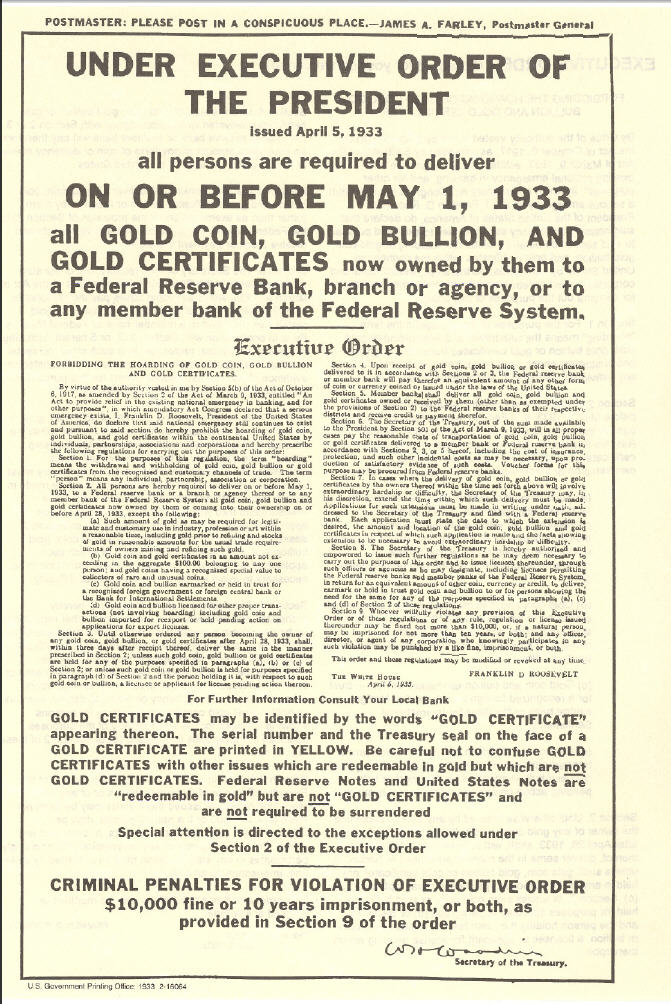

Safe deposit boxes may be safe from your average criminal, but well, the U.S. Government isn’t your average crimin–I mean, the U.S. Government has been known to forbid the ownership of gold and seize gold from citizens so… maybe let’s keep this on the down-low?

Truthfully, the likelihood of it happening again is pretty small, but well… we’re prepping, so it’s worth mentioning.

Realistically, it’s a lot more likely that your bank will close temporarily (all my bank’s local branches closed this week because I live in a COVID-19 hotspot, so it does happen) or that your bank will fail and collapse–taking anything you have entrusted to it right along with it.

Where does that leave you?

Probably without a paddle up a rather unfortunately named creek, huh?

Utilizing Your Assets

You’ve set aside food and water with the idea that, someday, you’ll need to use it. After all, that’s why you’ve made sure your bunker has a can opener, right?

Similarly, you should plan ahead a little about what’s going to happen when you need to use your gold or silver to get you out of a sticky financial situation.

-

25% off all OAKLEY products - OAKLEY25

Copied! Visit Merchant

First, some truths:

- Your precious metals are only worth what someone in your local area will pay you for them right now–no matter what the market reports say.

- If you cannot liquidate your investment quickly, you’ll either starve a very rich man or barter for the world’s most expensive can of Spaghetti-Os.

Don’t let these facts deter you, though. Gold, silver, platinum, and other precious metals are not hard to sell. You just need to know where and how to sell them when the time comes so you can free up your cash flow.

So what are you going to do? You’re going to shop around your local area for a dealer that works in precious metals, a pawn shop, or a jeweler with a good reputation, and you’re going to pay them a little visit to learn more about it.

-

25% off all OAKLEY products - OAKLEY25

Copied! Visit Merchant

Make a new friend, it’s totally worth it.

Conclusion

While diamonds may be a girl’s best friend, there’s no denying that gold has the power to see you and yours through some rough times. Sure, it’s not as simple as purchasing a bucket of dehydrated pasta dishes to stick in your garage, but it’s well worth the research and investment.

Do you invest in precious metals for an emergency? Are you going to start? Share your tips or your thoughts with the rest of us in the comments! And since you’re here, keep the ball rolling by checking out Prepping 101!

11 Leave a Reply

Thanks for the info

Yeah...this article is well thought out and informative. Just remember that Banks wanted you to have savings accounts...that way they could use your money to make money for themselves. Buy gold and silver only seems to benefit the ones selling it. You can't eat it, burn it, or use it for anything practical. Its only intrinsic value was in jewelry, and that was only as a show of wealth. I will always store knowledge and food and ammo. And especially things to carry said stores in.

Great article! Glad you picked-up on Executive Order 6102 -- so many folks' knee-jerk reaction is to keep this stuff in their safe deposit box! Back in the day, FDR stationed treasury agents at bank vaults with instructions to search every safe deposit box for gold. I think it is a Good Idea to keep an amount (depending on your own judgment) of gold and silver readily available. My view is that you want the most liquid forms of gold and silver in small denominations to facilitate exchange. The best choices (in my view) would be pre-1964 silver dimes (90% silver) which are recognizable, hard to counterfeit, and small enough in value to allow purchase of necessities. For bigger-ticket items, I would suggest 1/10 oz. gold coins from the US Mint, again because they are recognizable, hard to counterfeit, and small enough in value (current price is ~US$280 per coin) that they can be used for more big-ticket items without being so large they become illiquid (current 1 oz. coins are ~US$2,300). Note that you pay a premium for the smaller denominations and accompanying liquidity. I had not checked the price of gold recently. I stocked up on gold and silver in 2012. At that time, gold was selling for ~US$1,200 per oz. and everyone said it was a bad investment.

It seems everyone mentions gold with silver as an afterthought. IMO, gold is too valuable and in a SHTF scenario, if we were looking for a medium of exchange, silver would work better.

Naturally, straight trading (can of corn for can of peas) would be the first exchange method but once things settled down a bit and trade became more of a marketplace event, it would be easier to use silver. Silver is nearly as soft as gold and a Silver Eagle can easily be trimmed with a knife and weighted in an exchange. It would be more difficult to trim off a small amount of gold for a small transaction but easy to do so for silver. And just because gold is worth 50 times what silver is now, that may not always be the case.

Lastly, silver is easier to buy as it requires less of a capital outlay. Even a 1/10 oz. Gold Eagle costs 10 times what a Silver Eagle costs. I'm not an investment councilor in any way but I would suggest an 80% silver/20% gold cache put away where you find safest (safe, buried in the backyard, whatever) to be the most prudent advice. Again, just my opinion.

I agree with most said but I would say your recommendations of where to purchase are very mainstream but not the best deals. If you are looking for the raw melt value then buying shiny coins from Amazon might not be the best. I would stick to the local flea market. And if you want coins for their value stick to PCGS. An eagle should be less than twenty bucks and junk silver around 15 at the flea market.

Gold and too a lesser degree, silver, have always had intrinsic value in human civilization history, in all forms of record. That said, the value entirely depends upon the value the trader gives it. Is it worthless? In a true WROL and apocalyptic scenario, probably not to anyone that doesn’t think “normality” will return at some point. But except in those extreme circumstances, it will have some sort of value, despite not being to eat, shoot or really use it. It’s too hardwired into the human psyche.

I Agree Mike,

If you find me on LI I may know something. There is NO value in SHTF (or almost no value, as I mention below, with the correct connections and applications of The Prince, Snowflakes could do almost anything for a promise). Silver is by far "more rare" and used on an industrial scale than Gold so application wise has merit post dystopian. But to my point above, some a-hoke is going to set themselves up in a golden palace post event as well, so there is that opportunity as well for Gold.

Precious metals are a good long term investment if you lack faith in your government or economy, but actually hoarding them in a safe in your house is a bad idea from a general and apocalyptic perspective. You can get certificates of ownership or commodity ETFs that serve the same purpose and are much easier to buy and sell, as well as not requiring you to have a safe. Additionally, gold has little intrinsic value, so if you're in a disaster it's much better to have spent your money on supplies rather than a heap of heavy metals.

This is horrible advice.

Yes and No. Yes a big chunk is worth less than toilet paper, but when it comes to real setting yourself up as the next land baron, Gold is king. Silver is for trading, 1/4 oz or less for common items. Although I recommend 5 acres for folks starting out, Liquor, fuel (wind, solar, wood, CNG/Meth-separator), ammo, crops, chickens-eggs, cows-milk-butter-cheese, pigs, goats-milk-cheese.

Nice article. Definitely don't plan on being "wealthy" with a metal hoard post disaster but some physical is a good thing to have. If you don't have a safe there are bazillions of hiding places to avoid losing it in a burglary scenario.