If you’ve chatted up your FFL lately, you might have heard that gun sales are down – and it’s true. The firearm industry is facing a sales slump, an economic downturn, a bit of bad news.

Even SHOT Show 2025 was underwhelming. Sure, we saw a few cool new guns and gadgets, but it was nothing like the feasts of years past.

How bad is it? What’s behind this trend? What do the people who make a living selling guns have to say about it? We wanted answers to those questions, too, and we’ve done our homework.

Read on to get a peek behind the scenes!

Editor’s Note: We reached out to several gun manufacturers and retailers who declined to comment on this story.

Table of Contents

Loading…

Background Checks Are Down

The National Instant Criminal Background Check System, or NICS, is one of the best ways to check the firearm industry’s pulse. This system processes every background check (ATF Form 4473) from every FFL.

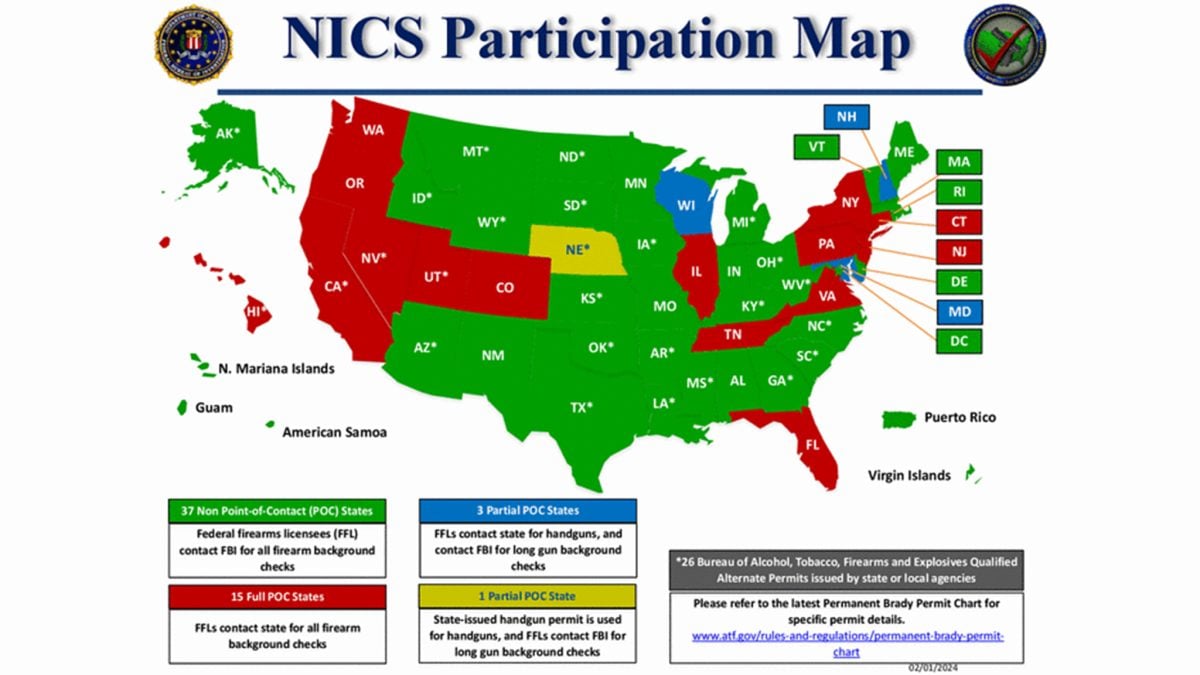

Background checks for firearm transfers aren’t all handled the same way, but they all end up in the NICS system.

In 31 states, five U.S. territories, and the District of Columbia, all background checks go from an FFL straight to the FBI.

Fifteen states handle background checks at the state level.

Four states share responsibility with the FBI. There, the state government handles background checks for handgun transfers, and the federal government handles background checks for long guns.

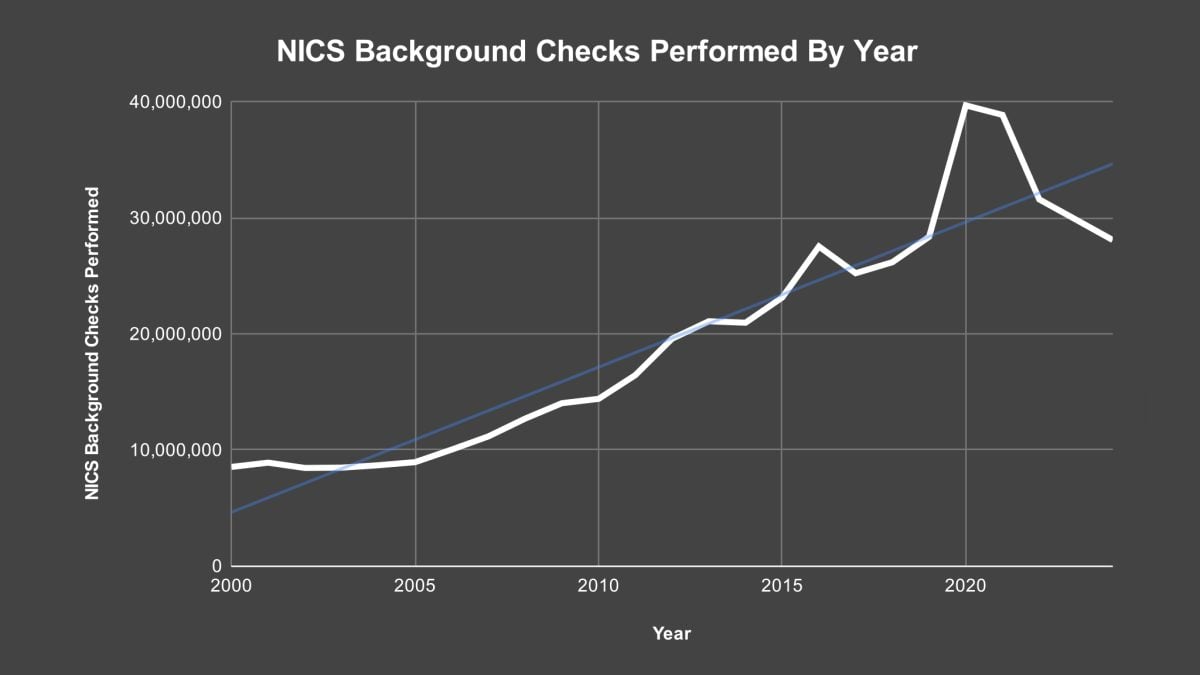

NICS gives us a consistent metric so we can make an apples-to-apples comparison over time.

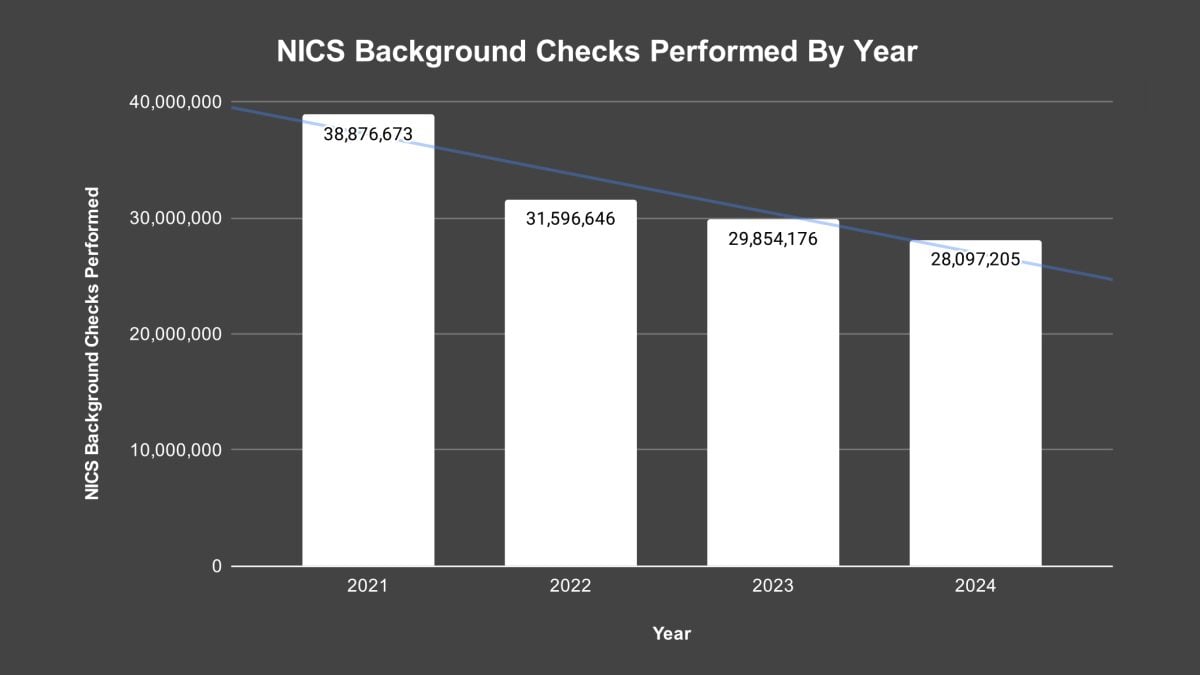

The most current NICS data shows a clear and steady decline in gun transfers from 38,876,673 in 2021 to 28,097,205 in 2024 — a nearly 28% drop.

What’s fueling the decline? We turned to retailers for answers.

Retailers Know The Backstory

The NICS database is great at tracking macro-level data trends, but it’s not very nuanced. To find out what this trend looks like at the ground level, we have to ask the businesses that keep the industry humming.

Jen Simunek, the director of marketing for Guns.com, said the company has seen fluctuations in prices, a decrease in background checks, and a widening of product variety during the past four years.

“Many variables can impact the gun market, from politics to international events, which can affect where and how firearms are sold,” Simunek said. “When there’s talk of a potential ban on a specific gun or model, sales tend to spike.”

Ryan Haas, Classic Firearms‘ chief financial officer and chief operations officer, described a combination of external factors that created a booming firearm industry just a few years ago.

“During the pandemic, social unrest created an atmosphere of fear, driving many first-time buyers from across all walks of life to purchase firearms for personal and home defense,” Haas said. “At the same time, consumers were flush with cash thanks to government stimulus payments while also having more personal recreation time thanks to growth in remote work, travel restrictions and less options for social activities.”

Both retailers have noticed distinct trends since 2021.

“One clear trend is the growing popularity of hunting, with strong sales in bolt-action rifles,” Simunek said. “Prices for semi-automatic polymer pistols and AR-15s are continuing to drop as more budget-friendly options hit the market. Handgun manufacturers are also stepping up, with more models now being built optic ready.”

At Classic Firearms, military surplus firearms remain a business staple, although there are fewer up for grabs than there were in the late 2010s. AK-style firearm sales seemed relatively stable — that is, until the war in Ukraine sucked all the air out of the AK and 7.62×39 ammunition markets.

“The AK market had been less volatile than the AR market in terms of rapid rise and declines,” Haas said. “However, events like the Russian invasion of Ukraine in 2022 and associated impact on imports, as well as the higher price of 7.62×39 ammunition and rising interest rates, put pressure on the AK market. In late-2023, the AK market began to fall, and that decline continued / accelerated in 2024 and remains depressed due in large part to the higher price point of AKs.”

Beyond firearm sales, business has been good.

“Ammo sales have been on the rise for the past two years, though shortages still happen from time to time, causing prices to spike,” Simunek said. “Meanwhile, silencer sales have grown and stayed strong, thanks to shorter ATF wait times, making the process smoother for buyers.”

Classic Firearms experienced a similar ebb and flow of ammunition sales.

“Ammunition, which is much more volatile price-wise than firearms, saw steep, rapid declines after the large price run-ups during the ammunition shortages early on during the pandemic,” Haas said. “During 2021, the average retail price of 9mm ammunition dropped ~52% from its January 2021 peak and continued to fall throughout 2022 and into 2023 before stabilizing mid-2023.”

He added, “Another immensely popular caliber, 5.56 NATO, saw a similar pattern with prices dropping ~38% in 2021 from its first quarter peak and continuing to decline until mid-2023 when prices finally stabilized.”

Recently, Haas has seen the market split. That reflects what we saw at SHOT Show — manufacturers were either tightening their belts or launching custom 2011s for $3,000 or more.

“One over-arching observation of the firearms consumer market in the last couple of years, especially 2024 and into 2025, is that there is a bifurcation in the marketplace,” Haas said. “The upper-end enthusiast market remains fairly stable in terms of product demand and pricing. The middle- and entry-level markets, on the other hand, are much more price sensitive.”

Haas attributes some of these effects to broad demographic changes.

“As the so-called “baby boomers” are retiring from the workforce (or approaching retirement), they shift from a spending mindset to a saving mindset, reflecting financial uncertainty that comes with increasing life expectancy at the same time prices for everyday essentials are increasing,” Haas said. “At the other end of the spectrum younger firearms consumers are paying off student loans, starting families, buying their first homes (in a higher interest rate environment) and experiencing challenges finding employment.

“National unemployment rates among men between the ages of 20–24 are nearly double the unemployment rate of the second-highest unemployment demographic, men 25–30 years old. The fact that both leading and trailing tails of the consumer buying spectrum are in flux creates headwinds for the industry.”

Guns.com has observed a consistent uptick in first-time and female customers. New gun owners are likely more budget-conscious, so the retailer has noticed periods of high demand for AR-15s under $400 and shotguns under $150.

What Does This Mean for Gun Owners?

Between the numbers from NICS and anecdotal observations from SHOT Show, the state of the firearm industry might look bleak. For the past four years, that’s been accurate.

But I’m old enough to remember when you couldn’t find so much as a bolt carrier group online. I’ve had gun store owners shout, “We’re sold out!” without looking up from their phones the second I walked in the door.

Those were COVID times. Could peak sales be skewing our perception?

In 2019, NICS data shows 28,369,750 gun transfers. That’s awfully close to the 28,097,205 we saw in 2024.

In 2020 – amid the pandemic, riots, and uncertainty about future firearm legislation – FBI background checks shot to an all-time high of 39,695,315. That’s a 40% increase in one year.

Of the FBI’s top 10 days for background checks, seven happened in 2020 or 2021. The top nine weeks for background checks all happened in 2020 or 2021.

Sales dropped significantly in 2022 and started to level out in 2023.

So yes, gun sales are down significantly, but we’re comparing them against a record high. It’s possible that the decline in demand isn’t representative of a decline in interest.

Once manufacturers sell off their excess inventory and the industry gets back on track, we could see innovation and investment once again. In the meantime, stay ready to pounce on discounted prices.

What trends have you noticed? Leave your predictions in the comments section so we all know if you end up being right! Curious about gun legislation? Read up on the SHUSH Act and follow all the latest industry news right here at Pew Pew Tactical!

7 Leave a Reply

Sadly gun manufacturers have fallen into a "GLockoff" make of new guns. We are going through a period similar to the 80s US car manufacturers where each damn car looks like the other. Gun manufacturers need to find new designs to make.

Yes Ammunition is up a bit but we need see something new.

On one hand, I think you're exactly right. On the other, you reminded me that Chrysler K-cars exist, which seems like cruel and unusual punishment. Ouch.

Although ammo prices have come down a little, premium rounds are still much higher than prior to 2020. I don't buy much of anything when it takes near $15 to fill one AR magazine. Target practice now is relegated to shooting a couple of groups to check scope. If they want to sell more guns, find a way to lower ammo prices.

Although ammo prices have come down a little, premium rounds are still much higher than prior to 2020. I don't buy much of anything when it takes near $15 to fill one AR magazine. Target practice now is relegated to shooting a couple of groups to check scope. If they want to sell more guns, find a way to lower ammo prices.

I hear you, Jack. Dry fire and shooting .22 LR are my favorite ways of getting quality reps while keeping ammo spending to a minimum. It's not a perfect approach, but it's something.

Insightful article. Nice read.

Thanks for reading, Kim!