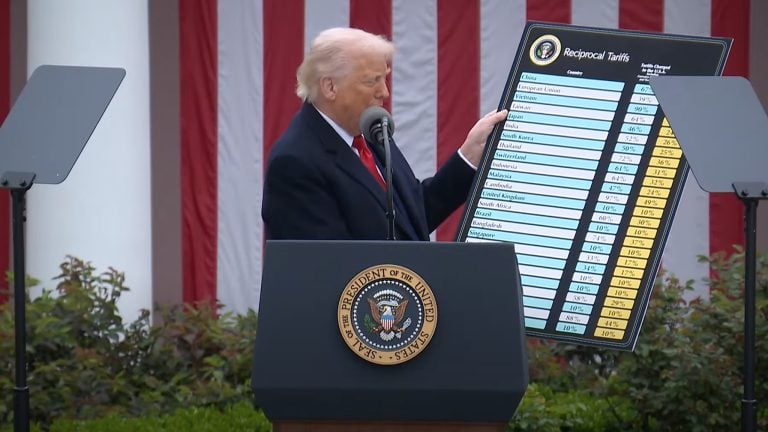

President Donald Trump announced a slew of new tariffs during an April 2 White House press event.

As new tariffs and ongoing negotiations continue to shake up the economy, many producers and consumers in the gun industry wonder how the current economic shakeup will affect them.

We’ll do our best to lay out the factors that affect how much you’ll pay for guns and ammunition and how available those goods will be.

Table of Contents

Loading…

Which Countries Are in the Crosshairs?

Tariffs have been a prominent feature of the Trump administration since he forecasted them in campaign speeches leading up to the 2024 election, as chronicled by PBS.

International trade became the dominant topic of discussion on April 2, when Trump unveiled a sweeping new tariff plan.

According to The Guardian, 85 sources of foreign goods appear on the list. Most are independent countries, but some, like Christmas Island (part of Australia) and Svalbard (a group of islands belonging to Norway), are not.

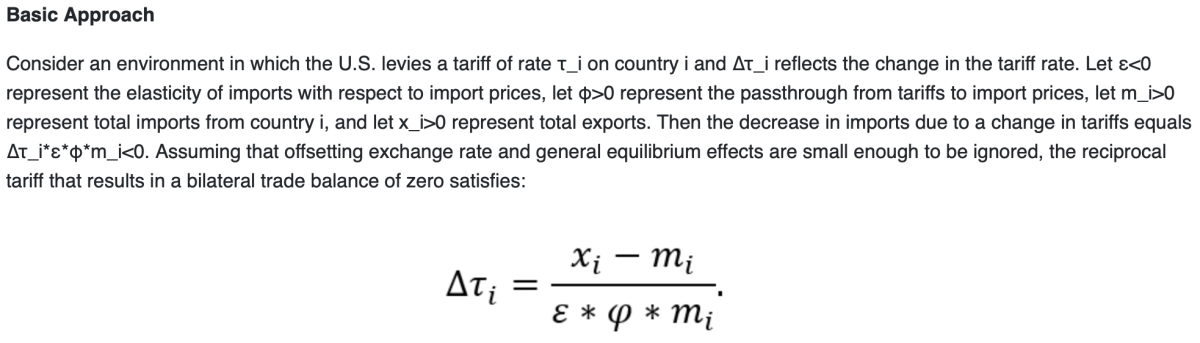

Each of these foreign sources has an individual tariff rate as of April 2. According to Axios, this rate is a function of the relationship between the U.S. trade deficit and imports from each country.

The formula for calculating the new tariff schedule is published in a report from the Office of the United States Trade Representative.

Canada and Mexico do not appear on the list of countries receiving new tariffs. They are, however, subject to a recently imposed 25% tariff on all goods that do not satisfy U.S.-Mexico-Canadia Trade Agreement criteria.

What Does That Mean For Guns?

The most obvious impact of these tariffs is increased prices on foreign firearms. Overseas manufacturers will have to pay to import their products into the U.S., and consumers will pick up the tab at the cash register.

Firearms Manufacturing

These resources all impact how much it costs to manufacture firearms and ammunition. The tariffs will also affect how much we pay for finished products that are assembled abroad.

For example, IWI builds all its firearms in Israel. As of April 2, Israeli imports are subject to a 17% tariff. Brands like Barrett, Daniel Defense, Henry, and Smith & Wesson build their products exclusively in the U.S., so tariffs would only drive up prices as a result of their materials getting more expensive.

In other cases, it’s less straightforward.

Springfield Armory is an American company that builds many of its firearms in Illinois. Others, like the popular Hellcat and Hellcat pro, come from HS Produkt in Croatia, which is subject to the 20% tariff on EU nations.

Weatherby is located in Wyoming, but the company builds many of its firearms in Japan (now subject to a 24% tariff) and Turkey (now subject to a 10% tariff).

The vast majority of optics we use come from overseas, even if the companies that design, develop, and sell them are American. The new 34% tariff on Chinese imports is likely to make your favorite scopes and red dots a lot more expensive.

On the other hand, Glock is an Austrian company with a factory in Georgia. American-made pistols are exempt from the tariff on EU goods, while Austrian ones are subject to the 20% EU tariff.

If the tariff schedule holds, we may see more foreign companies moving some of their production stateside, just like Beretta, Glock, FN, Heckler & Koch, and Walther did.

Ammunition Manufacturing

In the case of ammunition, one manufacturer has already addressed the effects of tariffs directly.

In a letter published by InRange TV, Sam Gabbert, the owner of SGAmmo, explained in detail how he expects to raise prices for various products as prices rise.

Gabbert pointed out that if a company operates on a 5% margin, it cannot absorb rising costs before they reach the customer.

“If I sell a $200 to $250 case of ammo, after I pay the shipping and other costs associated with the sale, we make $10 to $12 profit in the deal on average, and I cannot sell an item for 5% gain, only to buy it back in 3 weeks for 20% more,” Gabbert wrote.

Consumers should expect to see pricing changes rolled out over time rather than in one jump.

“SGAmmo’s price increases forced by the tariffs will all be done manually item by item after a review of the options,” Gabbert wrote. “There is no magic button here for me to push that just raises all the prices at once, the process will take at least a week up to a month to fully implement, and it will be a slow and spotty process as to what products are increased and when.”

Price increases will vary over time, from producer to producer and cartridge by cartridge.

According to Gabbert, the biggest price increases will affect 7.62×39, 5.56 NATO/.223 Rem, 9mm, 7.62 NATO/.308 Win, .38 Spl, .380 ACP, .44 Mag, and 12ga – in that order.

He pointed out that most low-volume European ammunition, like 7.62x54R and 8mm Mauser, comes from two factories in Europe and will be heavily impacted by the new tariff rates.

Traditional American rimfire cartridges like .22 LR, .22 WMR, .17 HMR, or hunting rounds like .243 Win, .270 Win, .30-06 Sprg, and .300 Win Mag, ammunition comes almost entirely from U.S. manufacturers and will not be affected by tariffs outside of material costs.

Materials

Even if firearms and ammunition come from domestic sources, the materials that manufacturers use to build them may not.

The firearm industry relies on various metals – notably steel, aluminum, lead, copper, and brass. Manufacturers can source commodities domestically or import them from foreign sources.

Trade figures don’t indicate exactly what will happen as a result of these tariffs, but they do provide some perspective on the degree to which U.S. consumption of a given commodity is reliant on or insulated from foreign sources.

Steel

Despite the popularity of polymer-framed pistols and aluminum sporting rifle receivers, steel will always be at the heart of the firearms industry. High-stress components like barrels, bolts, and slides rely on high-quality steel to withstand the pressure of cartridge ignition.

According to the United States Geological Survey, domestic steel production accounted for 81 million metric tons of steel in 2024. During the same time, the U.S. imported 26 million metric tons of steel and exported 8 million metric tons.

Of the imported steel, approximately 23% came from Canada, 16% came from Brazil, and 12% came from Mexico.

There were no tariffs on imported steel in 2024.

In March, CNN reported that the U.S. would impose a 25% tariff on Canadian steel. Mexico News Daily reported that a 25% tariff would also be imposed on Mexican steel imported into the U.S. As of April 2, Brazilian imports are subject to a 10% tariff.

Lead

Nearly every bullet fired contains lead. Frangible and solid copper bullets are notable exceptions.

According to the USGS, the U.S. produced 1,590,000 metric tons of lead in 2024. During the same time, the U.S. imported 420,000 metric tons of lead and exported 294,000 metric tons.

Existing U.S. tariffs on imported lead include a 2.5% tariff across the board and a 1.1-cent-per-kilogram tariff on the lead content of lead ore.

Of the imported lead, 32% came from Canada, 16% came from South Korea, and 14% came from Mexico.

Lead does not appear in the recent 25% tariff schedule on Canadian and Mexican imports, nor is it listed in the USMCA tariff schedule. As of April 2, South Korean imports are subject to a 25% tariff.

Copper

Copper is another critical commodity in ammunition manufacturing, notably full metal jacket and jacketed hollow point ammunition.

The USGS reported that, in 2024, the U.S. produced 2,140,000 metric tons of copper. During that time, the U.S. imported slightly more than 810,000 metric tons of copper and exported 380,000 metric tons.

In 2024, the U.S. imposed a 0-3% tariff on foreign copper, depending on its form, and a 1.7-cent-per-kilogram tariff on the lead content of copper ore.

Finland produced nearly all of the copper imported to the U.S. at 92%.

As of April 2, Finnish goods are subject to the 20% tariff placed on imports from the European Union.

The Outlook Ahead

We may not be able to predict exactly what will happen or how severe it will be, but it’s pretty clear that prices on guns and ammo are about to go up.

Some of that is due to tariffs, but there are downstream effects, too.

If Gabbert’s predictions about ammunition prices hold true, cartridges like .22 LR and .30-06 Sprg will be much more competitive than 5.56 NATO and 7.62 NATO, for example. That will push more consumers to seek deals on the more affordable and available option, which will, in turn, increase demand and prices for .22 LR and .30-06 Sprg.

The same goes for guns. If Croatian and Turkish imports are suddenly priced on par with American-made firearms, consumers might gravitate toward domestic products and boost those prices as a result. That’s the point of tariffs — make imported goods less financially attractive relative to domestic ones.

In the case of the gun industry, tariffs will increase prices. On the other hand, it could push consumers toward buying American-made products. Whether that’s a positive or negative outcome is up to you, but we should expect prices to go up across the board either way.

How much will prices rise? How long will they stay high? If we experience shortages, how severe and persistent will they be? That all depends on how long these tariffs stay in effect and how producers respond.

How have you dealt with market fluctuations in the past? Do you sit it out or stockpile? Let us know in the comments. Want to stay on top of the firearm industry? Catch all the latest updates in our news section.

5 Leave a Reply

Great data, Scott. It would be good for readers to know just how much the US is dependent on Australian and Canadian powders. It is huge! Our military powders are made near Tallahassee, FL.

Another factor not mentioned is that the tariffs will make Americans considerably poorer, leaving less money to spend on guns and ammunition. The tariffs are a massive tax on American consumers, the biggest peacetime tax increase in U.S. history. When Americans are struggling to make ends meet, and the high prices as a result of tariffs force people to choose between feeding their family, paying the mortgage, paying medical bills, and adding another gun to their collection, they'll likely choose feeding their family and keeping a roof over their head. This will hurt U.S. gun manufacturers. On the other hand, if the higher taxes cause civil unrest or a spike in crime, more people will also want guns, so it could be the case that bad news for America is good news for the gun industry.

Good perspective, DDG! It's definitely a give/take and a lot is kinda up in the air.

Just wanted to say that this is a fantastic piece on tariffs and gun ownership. Great job unpacking a complex topic with clarity and nuance, connecting economic policy to real-world impacts in the firearms space.

Thank you for the kind words, Dilan!